Monday, February 22, 2010

The big refinancing mountain is shrinking

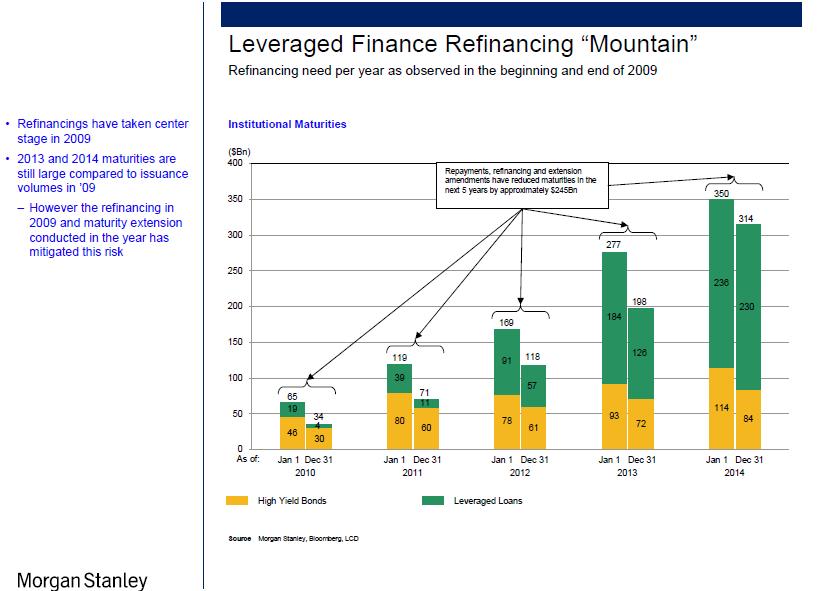

In the category of possibly good news there is this: the huge "refinancing mountain" is getting smaller.

One of the looming problems that rattles both bankers and government officials is the big pile of corporate debt that comes due from 2011-2014, the product of a huge wave of financing, particularly around LBOs and private equity deals, toward the end of the "bubble" years. The concern is that the much-diminished lending capacity of the corporate banks and the demise of the "shadow" banking industry will make it very expensive and in some cases impossible for much of that debt to be refinanced. That could cause more companies to fail for liquidity or financing reasons, thereby throwing more people out of work and otherwise damaging the "real" economy.

The good news, if you are looking for it, is that borrowers made substantial progress during 2009 against those future refinancing requirements. I got this table in my email last week. As you can see, the "mountain" shrank significantly in the last year. Unless the capital markets go south again, which nobody expects (not that they expected it the last time), the mountain should get smaller again in 2010.

Take your good news where you can get it.

1 Comments:

By Brian Schmidt, at Tue Feb 23, 12:39:00 AM:

Can't say I know much about this, but aren't we just putting off the problem a little later?

I suppose there's always hope it'll fix itself by then....