Saturday, July 16, 2011

A "thank you" that may, or may not, be in order

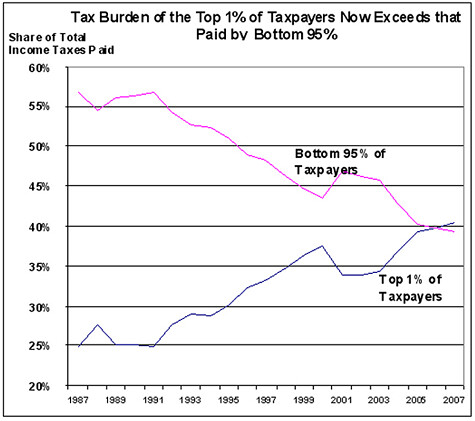

The top 1% are now paying more than half of all federal income tax collected by the United States Treasury. That is partly a function of the great progressivity of the "Bush" tax cuts, and partly because the top 1% are earning a higher percentage of the national income today than they did thirty years ago.

The question, of course, is whether this is a reason to thank the top 1% for their great contributions to GDP and the federal budget, or heap opprobrium on them and demand more. Your judgment in that probably depends on whether you believe that affluent people create their wealth, or appropriate it from more deserving people.

10 Comments:

By , at Sat Jul 16, 09:47:00 PM:

As a "roll-up" graph, this is too simplistic.

It doesn't include payroll taxes, which is a big distortion. We've been over this before.

Much of the increased incomes at the high end have been driven by government getting bigger, ironically. Can you say "Borg". We could have a very lengthy discussion of this, if you care. It'll be THE issue for our next generation, I expect, and may start the next Amercican Revolution. Let us pray ....

Capital gains treatment is also a big issue, and often demagogued by both sides. Once again we could have a very lengthy discussion of this, if you care..

Expect Obama & Co to continue to place well-placed barbs on these issues. They won't always be off target.

By TigerHawk, at Sun Jul 17, 08:43:00 AM:

Agreed on most of it, although I am not sure that your attribution of "increased incomes at the high end" to larger government is as provable as some of the other statements. Oh, sure, there are some big companies and some industries that have made a lot of money off of government contracting or policies, but I think the bigger causes are (i) globalization and (ii) rising complexity (which is a function of globalization). The first impact was discussed almost 20 years ago in a great little book called "The Winner Take All Society." The argument was that the top people/businesses/brands were now able to command such a large market that their incomes were soaring. Movie and sports stars have a global audience, top lawyers do business nationally and sometimes internationally, top surgeons are now accessible from around the country and the world, and so forth. In addition, business has gotten fantastically more complex than it was even 20 years ago, partly as a result of globalization and partly as a result of "larger government." Few people today realize how hard it is to run a multinational public company (fwiw, I have sorted of drifted in to becoming the CFO of a small one). The sheer quantity of stuff one needs to know is almost unbelievable, and the personal skills one needs to have are a lot more difficult to find than you might imagine. Add that to the fact that the capital markets are so demanding of performance very few corporate executives are in the top job or two for more than a few years -- either they get fired, or they burn out. So the people who can both do the top jobs in these large, complex, global, companies and survive in them are actually scarcer than hen's teeth.

Point is, I think those two considerations are bigger drivers of high incomes than big government per se.

By Gary Rosen, at Sun Jul 17, 01:37:00 PM:

You might question (and I'm generally Republican, pro-free-market, anti-Obama etc.) whether *all* the people earning those large salaries actually deserve them. I'm comfortable with the argument that if you are responsible for a company with profits in the millions, or billions, you should be compensated accordingly. Where it breaks down is that when someone screws up and *loses* huge amounts they usually have golden parachutes guaranteeing them millions anyway. I'm not saying they should owe what they would have made, but would it be so bad if they acutally had to work a 9-5 job?

In a sense this is the same argument against the "bailout" - protecting losers costs the rest of us money.

By Rabel, at Sun Jul 17, 07:11:00 PM:

"The top 1% are now paying more than half of all federal income tax collected by the United States Treasury."

I think you need to take another look at the graph.

By PD Quig, at Sun Jul 17, 09:02:00 PM:

I'll go along with the general tenor of all the comments so far: there is nothing wrong with making lots of money fair and square and paying high taxes, but I feel that there is something basic wrong when the tax base is so narrow. Everybody should be contributing something, no matter how little. No free riders.

On the other hand, those who have used their wealth to build outsized political influence which is then used to buy tax breaks, subsidies, regulatory impediments to their competitors, bailouts, etc. need to be brought to heel.

By Robert Arvanitis, at Mon Jul 18, 02:05:00 PM:

To ignoramus: We've been told endlessly that the OASDHI and Medicare charges are insurance premiums, NOT taxes. It all goes into your own personal lockbox, whose key Al Gore guards jealously.

To Gary Rosen: Excellent, but there is a more general and important point. Lady Gaga, Alex Rodriguez, Steve Jobs... whatever you think of their morals or talents, they have satisfied millions of consumers and deserve their money.

But Prince at Citi, and O'Neal at Merrill merely seduced a dozen directors. Even if they'd NOT lost billions, they would still not merit their pay. The issue is corporate governance and performance attribution.

By Clay B., at Mon Jul 18, 04:44:00 PM:

This kind of chart is impossible to interpret without also seeing what percentage of the income/wealth the two groups have.

By , at Mon Jul 18, 08:03:00 PM:

"insurance premiums, NOT taxes"

Just to amplify:

Social Security passed Constitutional muster back in the 1930s because it was expressly set-up as a tax-based transfer program. Back then, the Supreme Court had just overturned a federally-run "funded" old age plan for railroad workers. Social Security was sold to the Supreme Court as not creating any vested rights at all. FDR said different to the public.

This got clouded a bit by the Social Security "reforms" that got put in place around 1980 or 1981. But it still has enough bite to explain why the Obama's Individual Mandate got written as an amendment of the Internal Revenue Code to be policed by the IRS.

By Kamagra Online, at Tue Jul 19, 01:06:00 AM:

Thanks for taking the time to discuss this, I feel strongly about information and love learning more on this. If possible, as you gain expertise, It is extremely helpful for me. would you mind updating your blog with more information.

By Noumenon, at Wed Jul 20, 08:47:00 AM:

Naturally no one's going to thank the top 1% for their contribution to GDP, as they do it "from their regard to their own self interest", including the status.

If you put it as a choice between "create their wealth" and "appropriate it", I guess I lean more toward "appropriate." No one person can create that much wealth, just like no one person can lift an I-beam without a crane. The top 1% and the crane operator earn their pay, since the job couldn't get done without them; but it's the organization and the crane that do the actual heavy lifting and wealth creating.